(Bloomberg) — Financial markets look set to reopen Monday with investors squarely focused on escalating geopolitical tensions as Israel and Iran continue to bombard each other with no sign of a pause.

Most Read from Bloomberg

Israel on Sunday reported new missile attacks from Iran, and said it was carrying out simultaneous strikes on Tehran, as the two countries faced off for a third day in what is fast becoming the longtime adversaries’ most serious entanglement yet.

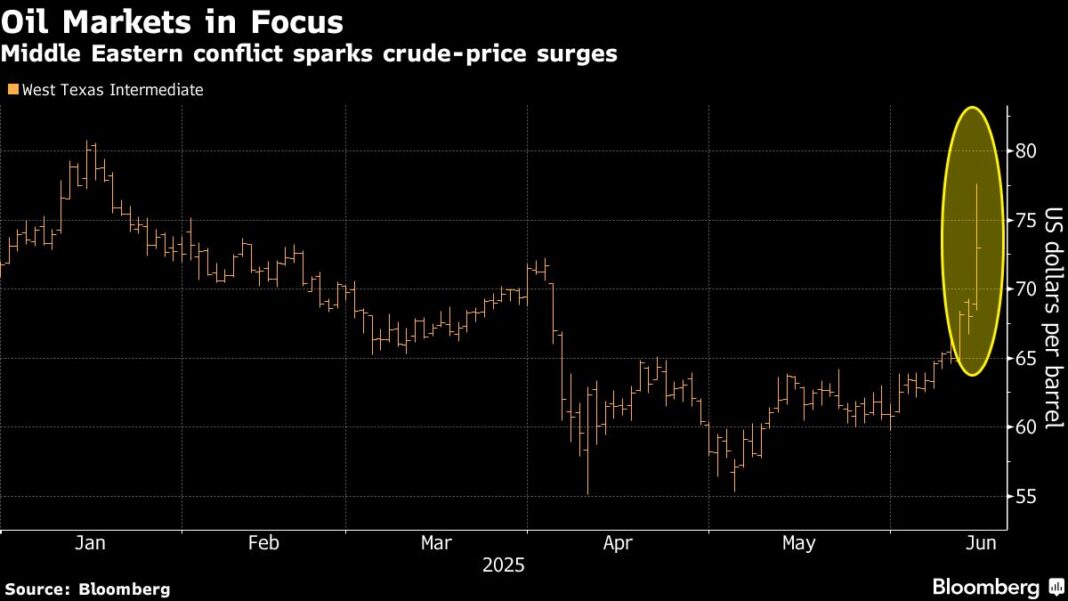

The biggest market reaction so far has been in oil, with crude prices surging more than 7% on Friday on concerns the conflict might widen to cause disruptions in a key oil-producing region. Traditional haven assets such as gold and the dollar rose, although fresh inflation fears undermined Treasuries.

The US currency opened mixed against major peers in early Asia trading Monday, edging higher against the euro but little changed against the yen. Norway’s krone slipped after its oil fueled climb last week.

Some investors ended last week choosing to wait to gauge how long the tensions would last, mindful of similar standoffs between the two nations that eventually de-escalated. Still, the extension of the conflict and intensity of the current hostilities is likely to cast a shadow over risk assets on Monday. Already, the MSCI World Index of developed-market equities fell the most since April on Friday following Israel’s initial air strikes on Iran.

“This is a significant escalation, to the point where these nations are at war,” said Michael O’Rourke, chief market strategist at JonesTrading. “The ramifications will be larger and last longer,” with weakness in equity markets likely, especially after recent gains, he said.

Regional Risks

In the region, most Middle East stock indexes dropped on Sunday. Egypt’s main gauge was the worst performer, seeing the biggest losses in more than a year on concern that a halt in Israeli gas production will cause fuel shortages. In Saudi Arabia, the Tadawul gauge’s declines were limited by Aramco, which gained on higher oil prices. Israel’s benchmark ended higher as military supplier Elbit Systems Ltd. rallied.

Traders are weighing the fresh geopolitical risks at a time when they are also grappling with destabilized global trade relationships, the prospect of new tariffs from US President Donald Trump, economic cross-currents, the ongoing conflict between Russia and Ukraine and rising political tensions in the US amid protests.

“Unless oil stays elevated and drives inflation higher, this is more likely a pause than a panic as other narratives are driving the market,” said Dave Mazza, chief executive officer, Roundhill Investments. “It may present a buying opportunity, but with markets having rallied sharply off recent lows, gains from here will be harder to come by.”

Following are comments from strategists and analysts on how they expect investors to respond on Monday:

George Saravelos, global head of FX strategy at Deutsche Bank AG

In the most negative scenario of a complete disruption to Iranian oil supply and a closure of the Strait of Hormuz, oil could rise to above $120 per barrel. Under a more restrained scenario of a 50% reduction in Iranian exports without broader disruption the oil price spike would be limited to around current levels, implying that this is the scenario that is currently priced by the market.

Wolf von Rotberg, equity strategist at Bank J. Safra Sarasin

Markets should be prepared for a prolonged period of uncertainty. The conflict will likely drag on for many more days. Risks are skewed to the downside. Hedging against potential oil supply-chain disruptions via exposure to the energy market and adding to gold, which may see an acceleration of its structural uptrend, are the best ways to protect a portfolio against a further escalation in the Middle East.

Hasnain Malik, strategist at Tellimer

The spike in the oil price reflects the risk of Iranian exports going offline but not a serious disruption to the Strait of Hormuz, through which 20% of global oil falls. Eastern European markets, however, provide an example of how quickly regional markets can recover if there are indications that the conflict will not spillover.

Martin Bercetche, founder at Frontier Road Ltd.

Volatility is here to stay and markets have not adjusted for the geopolitics question marks yet. This weekend has been an escalation, so markets should react negatively but I know enough to know the uncertainty will continue so I won’t try and guess where markets are headed.

Alexandre Hezez, chief investment officer at Group Richelieu

Oil prices, which had been declining for many months and allowed central banks to lower their rates, could now become a very disruptive factor for economies and lead to stagflation, a scenario that had previously been ruled out. How will central banks react in the event of an oil crisis? There is clearly a risk to both inflation and growth. The only protective assets remain oil and gold. The dollar is expected to strengthen.

Gilles Guibout, head of European equities at AXA IM

This is a catalyst that will likely trigger further profit-taking in stocks. Equity markets had sharply rallied lately with high valuations, notably in the US, amid a weakening economy and low expectations for earnings per share to grow. There’s nothing really in terms of tailwinds for the market. In terms of sectors, oil majors will likely be in heavy demand since the sector had underperformed lately. The spike in oil prices is changing the direction of travel.

Christopher Dembik, senior investment adviser at Pictet Asset Management

Since Wednesday, hedge funds and traders have been taking cover by purchasing VIX calls. It’s likely they will be strengthening these positions and tactically adding into gold and especially in defense stocks. As for oil, hedge funds have been net buyers since the end of May, while the rest of the market was selling at the same time. There’s no reason to liquidate these positions. It’s different for institutional investors. Many have simply added hedges but are making little change to their allocations because they know that this type of geopolitical event has little impact on their portfolios in the medium term.

Anthony Benichou, cross-asset sales trader at Liquidnet Alpha

Regarding oil, the Saudis have enough spare capacity to keep things under control, and Iran doesn’t have many good options. If they hit US assets, they risk pulling the US directly into the conflict. Unless the US gets involved, there’s no real oil shock coming. Even with the strike on Iran’s Tabriz refinery, supply looks steady. OPEC can easily make up for any small losses, just like they did during the Russia-Ukraine disruptions.

Andrea Tueni, head of sales trading at Saxo Banque France

Strictly for equities, this conflict is not a game changer. It’s localized and its real main impact is on oil. I don’t think that the Iranians will blockade the Strait of Hormuz but that of course would change the dimension of the conflict. Same thing if the US got directly involved, but that’s currently unlikely. That being said, the open will obviously not be great tomorrow.

Arthur Jurus, head of investment office at Oddo BHF Switzerland

A prolonged increase in oil prices could halt or even reverse the current disinflationary trend, that would force central banks to maintain rates at current levels for longer. The main uncertainty lies in the evolution of the US dollar, caught between a potential oil shock and the ongoing monetary realignment pursued by the US administration. Global economic growth may also be revised downward again. In such an environment, high-quality equities, those with strong cash flows, low debt, and positive earnings momentum, are likely to outperform.

Raphael Thuin, head of capital-market strategies at Tikehau Capital

There is currently limited geopolitical risk premium across equity markets but we can imagine it will start pricing itself. At the same time, there is arguably a regime change as far as safe havens are concerned. The dollar is not acting as the typical hedge it used to be against these kind of events, nor are Treasuries. It’s now gold or silver or different types of stores of value that play that role now.

Dennis Debusschere, founder of 22V Research

In the extreme, it’s really tough to hedge war or geopolitical risk. Does it makes sense to lighten up a bit on Nvidia ahead of a nuclear event? Put a bit of risk premium in the market ahead world catastrophe? No. It makes sense to own tail hedges against such an outcome.

To assume a sustained selloff in markets based on a war, air strikes, etcetera, investors need to make a call that a lasting impact on inflation, earnings or real rates is likely. This is the key factor. So if inflation spikes are expected to be temporary and there is no obvious downside earnings risk to US stocks, buying war-related dips has been profitable.

Doug Ramsey, chief investment officer at the Leuthold Group

I certainly would not view the dip as a buying opportunity. Consumer and CEO confidence is already very low, and the conflict could knock it down another notch.

Steve Sosnick, chief strategist at Interactive Brokers

Short-term, it could mean more headline risks for US stocks over the weekend and following days as the situation develops. This has all sorts of ways that this could go south. Given the positive momentum and sentiment among traders, they feel this only warrants modest caution for now. When geopolitics come into play, I prefer to look at commodities and bonds. They’re less distracted by narratives. Oil traders are telling us that they are not unconcerned. Maybe not panicking, but clearly not sanguine.

Vincent Juvyns, chief investment strategist at ING

I’m not expecting a selloff. Possibly the market will be a bit feverish, but I’m not expecting a rout. We don’t think there is a need to reduce our equity exposure even if we are neutral on the asset class. At the moment, our base-case scenario is that the conflict doesn’t escalate into a major regional crisis.

Ben Emons, founder of FedWatch Advisors

Financial conditions will tighten on higher oil prices, rising yields and lower equities. So it’s likely to be a continuation of what happened on Friday. The key is where oil goes from here. Bonds are lacking a safe haven bid because higher oil prices will change the inflation picture.

Michael Brown, strategist at Pepperstone Group

I struggle to see this as a big game-changer over the medium- and longer-run, however, if history is a guide, markets tend to be very quick to price geopolitical risk, but similarly rapid to fade the fear as well. Gold & crude are likely the big winners in the short-term. I’d expect any sustained crude upside to need a further escalation in conflict, likely targeting Iran’s crude infrastructure.

Marko Papic, chief strategist at BCA Research

Investors should be nimble. In the very near-term, markets will use this conflict to sell off after a bumper crop May. But this is very much a buy-the-dip risk. Especially as the inflationary effects of higher oil prices will be both temporary and will have no impact on monetary policy. No central bank is going to hike rates because of Israel and Iran.

Art Hogan, chief market strategist at B. Riley Wealth Management

One of the most difficult parts of interpreting how to react to geopolitical events like the current one, and those in our recent past, is it’s very difficult to model out what the economic cost will be. We feel that while we are still in the escalation phase of this current attack on Iran, it will be hard for investors to gain confidence to get back in the markets until we get to a place where we see an exit ramp on this current attack.

–With assistance from Elena Popina, Yiqin Shen, Ye Xie and Vildana Hajric.

(Updates with early currency moves)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.